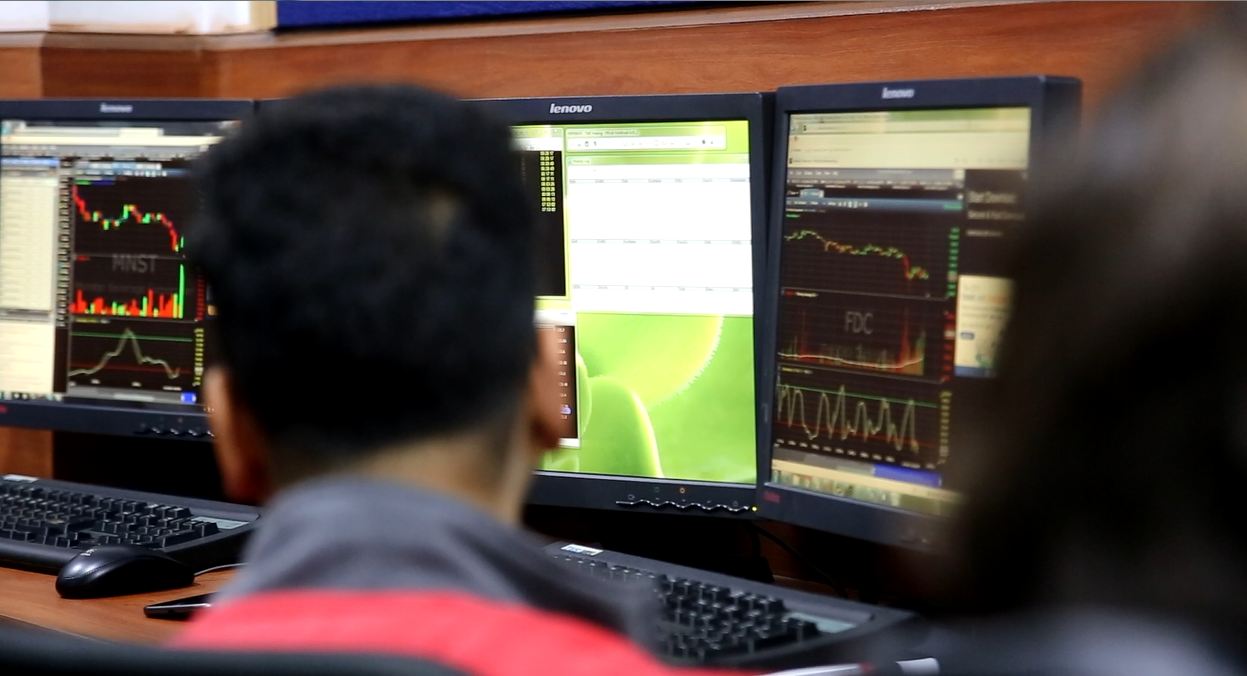

Share market tutorial in Patna– Capital market courses in Patna – Online share trading courses in Patna

While Wall Street generally defines a bear market as a 20% decline, the average bear market drops quite a bit more. As of this writing, the market has declined over 14% from its April high.Daytrading stocks during market declines can prove to be quite the challenge for day traders no matter how much experience they have. This is due to the fact that market volatility has a tendency to increase during most market declines, whether they are short term corrections or the typical bear market. This increase in volatility can wipe out the trading capital of even the experienced trader if they do not adjust their trading.Generally speaking, after large run-ups in stock prices, or in any market, there will be violent pull-backs. While this increase in volatility can produce some big directional moves, there may be sizable intraday swings that can catch a trader off guard.

With this in mind, how does a daytrader prepare for these changing conditions? Well, most daytraders are not in the business of forecasting market direction, but it can be very helpful to pay attention to some technical and psychological indicators that may provide a clue regarding market direction. Those indicators include price and volume, the TRIN, New 52 week highs and lows, the advance/decline line, the number of bullish vs. bearish investors, etc. A more detailed discussion regarding these indicators is more suitable for another article.

When a daytrader becomes aware that the market character has changed to a bearish tone, then it is time to adjust their thinking when it comes to managing trades. First of all, due to the usual increase in market volatility, the trader should scale back position size. While it may have been reasonable to trade 1,000 shares in a stock during a bull move, 500 shares might be more reasonable in a bear move. The novice daytrader will think they are losing out on a sizable profit opportunity by trading smaller during these major down moves. The experienced trader realizes that it is more important to preserve capital for time periods when the market is more predictable and less volatile.

One other issue facing daytraders during these bear markets is that the market has a tendency to have sharp intraday reversals, and there tends to be more sizable opening gaps. As some daytraders actually do carry positions over night, it is a good idea to carry smaller positions over night due to the greater risk of a market reversal.

The daytrader should also be aware that the overall long term market tendency is for stocks to trade higher each day. As such, even while the market is in a downtrend, quite a few trading days will close to the upside. During the current down move, nearly 40% of the trading days have closed to the upside. If a daytrader can recognize that even bear markets will pause for a breather, they will recognize significant opportunities to profit after these brief pauses when the market resumes its downtrend.

Daytraders should also consider trading other vehicles besides individual stocks during bear markets. This is due to the fact that it costs the trader extra to short a stock, since they must first borrow the shares from their broker, and pay interest on those shares, in order to sell the stock short. Therefore, daytraders should consider trading stock index futures, or ETFs that rise when the market falls. It is important that traders consider the cost of their trades, not just whether they make a profit or loss.

ICFM is one of the best stock market institutes providing technical analysis course, option trading course strategies, share market diploma and certification.

Register Now :: https://goo.gl/UnOx6m

Email :: info@icfmindia.com

Contact Number :: 09971900635